Mortgage Considerations

One important piece of the home buying puzzle is finances and the mortgage considerations that come with them! Let’s get started on the things we need to think about when creating your new home budget.

Your home is the biggest investment you may make, let’s make it a good one!

Create a Budget & Save for Your Down Payment

Before we buy curtains and throw pillows, we need to figure out what a comfortable home payment is for you. With my financial background, I am happy to start this discussion and then I will connect you with mortgage professionals who will help you look at your financial picture and help determine a realistic budget for you.

While there are still some home loan programs that will require very little down, the more you are able to put down, the more security you may feel. A 20% down payment will help you avoid additional monthly fees on your mortgage payment.

Consider Other Expenses

The home buying process comes with other costs, including inspection, appraisal and closing costs.

You may have additional expenses like appliance purchases, furniture or landscaping once you are settled in your new place to make it your home.

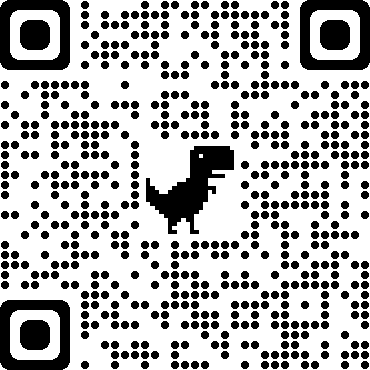

Mortgage Calculator

Below is a mortgage calculator to get you started on thinking about this piece of your home buying journey.

You will need to determine, with the help of your mortgage professional, the repayment schedule, down payment and other terms that are right for you.

Shop Around for a Mortgage Loan

To find the right mortgage loan for your home purchase, you can work with a local bank or credit union, a regional or national bank such as Commerce Bank, US Bank, or Bank of America, or a mortgage broker who will bring you options from a variety of lenders.

There are several different types of home loans available which can serve a variety of purposes and/or homebuyers. Some of these include Conventional, VA, and FHA.

It may be helpful for you to research current interest rates for Kansas City as well as the different programs available so you can compare quotes from the different lenders.

What Repayment Schedule Makes Sense?

You will have to decide based on your credit and your financial position, what repayment term best fits your budget and financial goals. Most mortgage loans are set to repay over 15, 20, or 30 years.

Another option is whether or not the rate will adjust over time. An ARM (adjustable rate mortgage), may give you lower rates during the initial term, but could go up over time based on changing financial markets. A fixed rate loan will give you security of your rate staying the same over the life of the loan, but may not give you a lower rate initially.

Get Pre-Qualified or Pre-Approved for a Loan

In today’s quick moving market, it is best if you get prequalified or preapproved before putting offers in on homes.

This will let the sellers know that you are serious about home buying and have the financial wherewithal to complete the transaction. It shows them that a qualified mortgage professional has reviewed your file and will help you to determine your home buying budget parameters.

It may make your offer more appealing once we find you the home that fits and make the home shopping experience less stressful for everyone.

Mortgage Considerations? - Contact Me Today to Get Started